URF.ASX update

Bulk sale falls over but 10% buyback announced - individual sales recommence - rents increasing 10% - activists on the register and still trades >50% discount to pretax NAV...

Please read my previous notes for context:

This is 100% my personal view and NOT advice - see disclaimer - I own both URF/URFPA at the time of writing.

BULK SALE FALLS OVER

Brooksville/Rockpoint walked away from their bid for the majority of URF properties on the last day of their DD period

The bid was at a horrendous 19% or AUD >160m discount to 31/12 independent valuations despite URF having sold USD 200m in properties over the past two years roughly in line with book values

The bidders cited “deterioration in the market conditions…. increased interest rate environment and broader economic uncertainty” with 30 year mortgage rates moving from 3% to now circa 6% in six months which will obviously have an impact

I suspect the ords which were trading well above the 22 cents implied under the deal further deterred the buyers as it was likely to be voted down

Considering URFPA was to be repaid in full if the deal proceeded - it’s no surprise the ords have rallied since and URFPA has fallen back to the effective conversion value which is now likely on 1 Jan 2023

Today’s price of $64 for URFPA will receive $6 in dividends until conversion - so $58 effective entry divided by 205 - the max number of ords to be issued per pref - is circa 28 cents per ord hence todays price seems fair

URF will report NAV going forward on the assumption URFPA is fully converted - the latest being 59 cents pre tax - 55 cents post as values have now reverted to the 31/12/2021 independent valuations as below - I’ll discuss later whether this is fair

Pre tax NAV is likely over 60 cents with the AUD/USD today hovering below 70c

Conversion also results in URF being geared far more conservatively at circa 50% - debt to total assets if you accept current book values and 7-8% of total assets are cash

URFPA is AUD denominated so the conversion leaves the ordinary shares less exposed to the currency swings – albiet it is still a significant consideration as all assets/liabilities are now in USD

Despite the deferred tax liability being reinstated - I view the tax as neutral considering I and likely other investors (not advice) could use this tax credit so personally assess URF on a pre tax basis

PLAN B

G/A TO BE CUT

URF has since announced G/A costs to fall to AUD 9m as one CEO has been let go

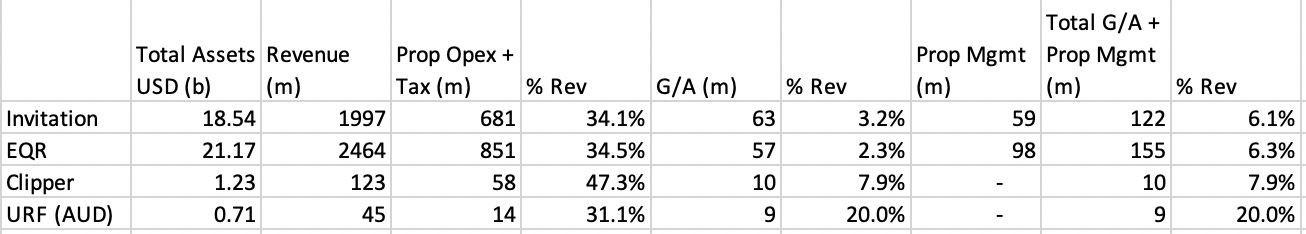

This is still excessive and >20% of revenue when most peers are below 10% - especially so when URF is a passive rent collector v peers who are buying, selling, renovating, developing etc so would require a larger team – G/A at 10% of revenue brings URF closer to AUD 5m

URF has also stated it will look to further reduce costs and potentially outsource the entire US platform which is sensible – having an Australian based responsible entity (RE) plus a US in house team to manage US housing is not efficient nor cost effective

Whilst not a perfect comparison - the Australian listed real estate agency McGrath – MEA.ASX – manages circa 8000 properties at a cost of AUD 15m pa or $1,875 per property. URF owns 479 properties or 885 units (some single but some 2-4 units also). So if we conservatively use the 885 units figure – that implies the cost to manage is a mere AUD 1.66m TOTAL – clearly G/A can be reduced further.

RENTS RISING / FFO POSITIVE

In 2Q22 – URF has achieved 11% increases for new rentals – 8% for renewals – and NY specifically was up 16%/14% for new/renewals

Revenue for the most recent Q was AUD 10.4m or 41.5m annualised - and assuming occupancy remains at 98% - if rents on average are up 10% across the portfolio revenue should rise to 45.5m

If you deduct the AUD 13.5m annualised property level expenses (I assume these could fall further if management was outsourced)

Net operating income (NOI) is AUD 32m

URF has USD 348m of debt which is fixed at 4% or the next 3.5 years assuming no debt paydown (5% pa allowed but why would you when the rate is now in the money?)

Thus USD 14m of interest or AUD 20m or near 50% of historical revenue so any rent increases have a big impact from here

Pre G/A earnings is therefore AUD 12m and AUD 3m post

If URF can as I expect reduce G/A to AUD 5m – URF could theoretically produce a small but decent FFO of AUD 7m

If we assume URFPA converts in full – 809m shares on issue – 28c market cap is $226m – that’s provides a 3% FFO yield – nothing exceptional but sure beats the Aussie punter who negatively gears their property empire especially in the current environment

Single family REIT’s like Invitation Homes – American Homes 4 Rent – generally are the lowest dividend yielding REIT class at around 1-2% so on that basis URF seems fair if it were to ever pay a dividend

However URF also stated “necessary capital expenditure is expected to result in the Fund continuing to experience a negative overall cash flow, even after the expected conversion of the CPUs” which at least was honest compared to the majority of REITs who only quote FFO – however this reaffirms my belief that URF should be wound up as it has limited appeal as a listed vehicle.

This statement is also based on inflated G/A costs so I’d estimate overall positive cashflow positive is very achievable near term. If URF can achieve FFO of AUD 7m - I’d be very surprised if the URF newly renovated portfolio required a similar amount that for capex when 30% of rent is already spent on property level expenses and taxes. Below is AUD:

ON MARKET BUYBACK OF BOTH URF/URFPA

10% of both URF/URFPA has been announced but the RE indicated this could increase subject to shareholder approval - the buyback can start at the end of June 2022

URF claims to have current surplus funds of USD 20m or AUD 28.5m

URF had total USD cash >50m or AUD 70m as per their last quarterly and this will grow from here with any future individual sales hence I strongly believe the claimed surplus of roughly 40% of the total cash balance is a very soft target especially if URF is FFO positive

The current market cap at 28c ords / $64 URFPA is circa $240m so even on the conservative claimed surplus cash – that’s over 10% of the current market cap and very accretive at the >50% discount to pretax NAV

URF also has a small multifamily JV interest worth USD 10.8m equity / book value which should have been sold already as multifamily (apartment blocks) has a much wider pool of buyers – however this is now being “evaluated and explored”

If book value is achieved – this adds another circa AUD 15m for further buybacks

CONCLUSION/RISKS – NEAR 30% GROSS BUFFER

The above table highlights the sensitivity for NAV under any fall in property values.

URF should and will likely still be wound up - whether in a larger portfolio sale or individually so this could take a few years yet. Both the RE and the register I believe strongly support a windup - especially the RE considering the eagerness to accept the 19% discount from the recent proposal. EP1 has waived all fees aside from an 8 basis point RE fee - still AUD 800k which could come down - but there is little if any incentive for EP1 to keep URF alive. It has torched plenty of their clients (originally Dixon) so I believe a windup is their strong preference so they can further distance themselves from URF - it’s now a matter of how the windup is best achieved and what will realise the highest value.

A larger sale of different geographies such as NJ workforce portfolio is still possible - it has a higher NOI yield of 4.1% compared to the premium segments which are 2.8% - thus could appeal to institutional buyers. I’d be confident there will be no early repayment penalty on the debt or “yield maintenance” considering this debt is now in the money.

Individual sales however incur 5-7% selling costs - and the rising mortgage rates will likely see prices fall albeit rising rents should help offset this. Residential real estate has historically outperformed in periods of stagflation/inflation - especially for a newly renovated portfolio which has nothing in the development pipeline.

My base case thus assumes a 15% discount to gross property values (50/50 price falls plus transaction costs) which still provides a pretax NAV 44 cents. This doesn’t adjust for the buyback which is very accretive provided asset values don’t fall 30%. We should get more clarity on the fairness of book values in the coming months with results from further individual sales.

URF today however trades at >50% discount to the fully diluted pretax NAV on 31/12 values – and implies a near 30% fall in gross property values which would reduce the NAV to the current share price of 28c.

This provides a solid buffer and I see this scenario as unlikely. Such a fall would be greater than the GFC when US national prices fell 26% in nominal terms. URF portfolio - despite the national housing boom had increased less than 5% over the past two years and were impaired by 10% in the preceding years. Maybe the values were inflated to begin with - but it’s clear URF has hardly benefited from the national housing boom thus I think will outperform in any downturn.

Blackstone recently stated average asking rents in NY are 19% above pre COVID levels which doesn’t imply the housing market demand is about to collapse. Similar prime and land locked financial cities like London are performing well as people return to financial hubs and the office as COVID impacts recede. Listings in NY for housing is extremely tight - and generally in times of distress this tightens further - which could support house prices and provide a good opportunity for URF to restart individual sales.

If however a GFC 26% fall did occur - valuing the URF portfolio at USD 455m - gearing jumps back to circa 65% which I believe is still manageable especially as interest costs are fixed and the fund is FFO positive. Gross rents before taxes and property level expenses should be USD 32m - providing a 7% gross yield. Sydney housing as below is closer to 2% gross for housing - Melbourne is very similar. Even when you deduct URF taxes and property level expenses - NOI of USD 22.5m provides a 5% yield with GFC type fall.

Samuel Terry have now disclosed a 7% stake in the ords and 5% of URFPA. I respect them highly and they have a solid track record in taking an active approach to realise shareholder value and closing discounts to NAV – recent examples include FAR.ASX, NAM.ASX and KIL.ASX. I’m confident that at least 20% of the register today – institutions and family offices - share this active approach and are all very motivated to see shareholder value restored and will keep the RE honest and working towards this outcome.

So today URF is soon to be FFO positive – comfortably geared – has rising rents yet fixed interest costs – an accretive buyback providing downside support – an active register – and most importantly still trades at >50% discount to NAV or 30% implied gross fall in assets. URF in my view remains asymmetric at the current price provided we don’t see another GFC – and even then this isn’t a bad place to hide considering the starting point valuation.

Charlie Kingston

Director

CSK Capital Pty Ltd

DISCLAIMER

Do not interpret anything above as financial advice. This article has been prepared by the author, CSK Capital Pty Ltd for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. While the Author believes that such forward-looking statements and opinions are reasonable, they are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author may or may not hold a position in the security mentioned and may trade the security in future. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.

APPENDIX

GFC fall in for National US house prices below:

NY housing below - it fell less and bounced back quicker post GFC compared to the national average - URF certainly has hardly reflected any of the 2020 onwards price surge.

Might be time for another update. Assuming they achieve the US$150m targeted asset sales in 2024 (run-rating Feb-YTD sales exceeds this number), adjusting for mandatory debt repayment, transaction costs, negative FFO and $5m in buy-backs delivers c.13c of potential special distributions this calendar year with 2/3rds of the portfolio remaining (and probably still trading at a discount to NAV). Sensitising for a lower sale program and appreciating AUD still looks unusually attractive.

Amazing work!