URF.ASX update

URF has announced a disappointing sale agreement at a near 19% discount to last stated book values...

Please read my previous two notes on URF for further context.

I own both URFPA and URF at the time of writing and prior to the below announcement I had roughly 50/50 exposure to both. I am still well ahead on my investment however less than what I had expected after the recently announced deal.

This is 100% my personal view and NOT advice - see disclaimer.

ORDINARY SHAREHOLDERS LEFT WITH THE SCRAPS YET URFPA PAID IN FULL:

URF has announced a very disappointing deal for ordinary shareholders and entered a sale agreement with Brooksville and Rockpoint to sell the entire 1-4 Family property portfolio at a near 19% discount to 31/12/2021 book values. In summary:

Ords to receive 22 cents assuming AUD/USD remains at 75c

This compares to the pre tax NAV announced last week to 68c

URFPA to be repaid in full at $100 plus any remaining dividends – circa $3

ONLY ords to vote - see appendix

Current proposal implies a 19% discount to most recent book values

Alternatives include either selling properties individually at a URF stated “equity cost” of 10%

Or retaining the properties in which URF will be FFO positive this year

URFPA could still be converted at election of URF – not unitholders – 1 Jan 2023 if bid falls over

Risks from here include the bidders walking, FX movement, US housing market exposure in rising rate environment

Conversely the current proposal could be increased as shareholder support at the current 19% discount is unlikely as suggested by today ords trading at 22c and prefs at $80

OR another buyer could emerge

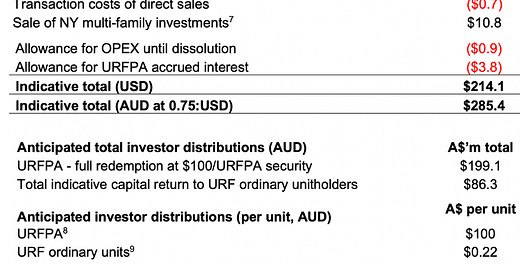

Under the current proposal - once debt is assumed by the new buyers and some other small adjustments – USD 214m will be leftover. URFPA (prefs) are to be repaid in full if the deal proceeds and ordinary shareholders (ords) will receive an estimated 22c if the AUD/USD remains at 75c as per the below table from URF.

I am genuinely surprised that URF has accepted this deal when they announce weekly NAV updates – most recently the pre tax NAV was 68c – such a major discount is unacceptable.

The capital stack is vital here – on liquidation URFPA are preferred. There is huge leverage involved for the URF ordinaries – geared at over 70% if you treat URFPA as debt. However when you consider the alternative as URF has stated is an accelerated individual sale process which would bear a “10% equity cost” – compared to the current proposed near 19% discount to book value – the preferred option is obvious.

This proposal will need ONLY ordinary shareholder approval (over 50% of those voting) – see appendix for confirmation from URF investor relations.

WILL IT BE APPROVED?

Today the market is suggesting the deal will struggle to find support considering URFPA is trading at $80 compared to the $100 plus dividends if it were approved. A reminder that URFPA can be mandatorily converted to ords on 1 Jan 2023 ONLY at the discretion of the responsible entity – there is a step up of 2.25% in coupon from the current 6.25% to 8.75% on this date if no conversion. Note that pref holders cannot elect conversion – more on this later.

The ords today trade at 22c which is the estimated proceeds under the current proposal so presumably few if any of todays buyers are going to be supportive of the current deal and there has been a decent amount of turnover this week. URF for almost a year has traded well above 22c so it is likely that many of the buyers in that time would also be unsupportive.

Todays buyers expect this deal to fall over – replaced by an increased purchase price from either the current bidder or an alternative party or the commencement of sales on individual property basis. Also note the value depends partly on AUD/USD rate - if URFPA is treated as debt and repaid in full – a 1c move in the AUD/USD results in circa a 1.5 cent per share move in the ords.

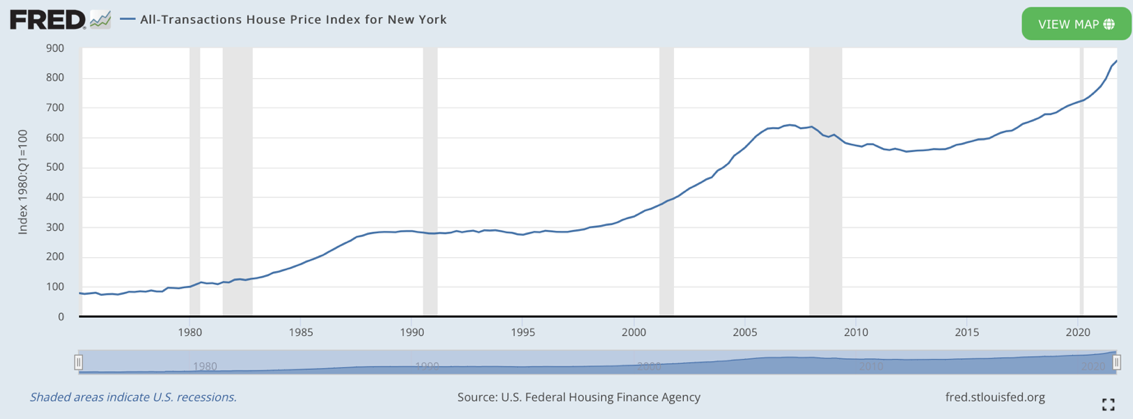

Personally I support a wind up of URF – but its unacceptable to sell the assets at such a whopping discount when all market indicators point to continued strength in US housing and rapidly rising rents – including New York and New Jersey as workers return to the cities and COVID impacts recede. URF must be one of the only vendors accepting a huge discount in the current supply constrained and booming market.

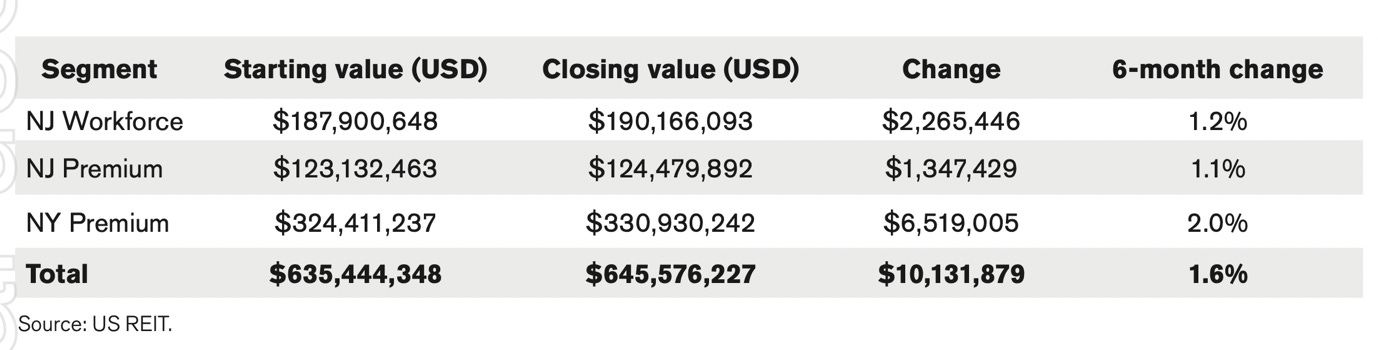

URF in their most recent accounts as at 31/12/2021 increased their book value of investment properties based on independent valuations by 1.6%.

To repeat they last week announced their weekly pre tax NAV was 68c.

SO WHY THE DISCOUNT?

Either the independent valuations were horribly overstated and the near 19% discount genuinely reflects current market values which I personally struggle to accept. URF has sold near USD 200m of properties over the past two years with gross proceeds roughly in line with book values.

Alternatively EP1 which owns the responsible entity that manages URF - Chaired by Stuart Nisbett – may have put their own desire to wind up URF as swiftly as possible before their stated goal to “provide value for unitholders” and pursue a strategy that “maximises the equity value of the Fund”.

In Stuart’s recent Chairman letter from one month ago – he noted absent a bulk sale there are multiple alternative paths forward such as retaining the portfolio or selling properties individually on an expedited basis – I’ll come to these shortly.

HOW DID URF CLAIM AN 11% DISCOUNT?

URF has claimed the current proposal is at an 11% discount on an “unencumbered post tax” basis to the most recent property valuations which:

takes the most recent book value of circa USD 623m in investment properties (excluding those held for sale)

deducts the deferred tax liability of USD 27m – notwithstanding this may not be payable under a bulk transaction

deducts the 28m “yield maintenance cost” which is effectively an early repayment fee if URF were to repay its USD 348m debt facility today – see appendix for full explanation

then applies an 11% discount to that reduced “unencumbered post tax” amount

Which is how they then arrive at a sale value of USD 507m and supposed 11% discount - despite this being a near 19% discount to the current book value for investment properties of USD 623m.

INDIVIDUAL SALE ALTERNATIVE?

Even if you were to accept the claimed 11% discount – in the most recent full year accounts released roughly one month ago URF explicitly stated “the equity cost” to sell properties individually would be 10% and any bulk portfolio sale would be benchmarked against this possibility:

“to the net realisable value of the 1-4 Family property assets on an accelerated one-by- one sale basis, and the time, tax leakage and execution risks associated with such an approach. We note that transaction costs in the range of 5% - 7.5% have been realised during the Fund’s recently completed asset sale program, which equates to a 10% equity cost based on the Fund’s level of gearing.”

It is hard to reconcile how accepting a near 19% discount is preferable to the above alternative for ordinary shareholders.

Certain shareholders could potentially use the deferred tax liability of USD 27m if properties are sold individually and URF pays this US tax- so to deduct this from the gross property value and then apply a further discount I believe is inappropriate and a gift to Brooksville/Rockpoint - noting the buyer would not pay the tax.

Also the senior debt facility of USD 348m allows for 5% annual early repayments and can be fully repaid in roughly 3.5 years from now. It has a fixed interest rate of 4% pa which in todays world of rapidly rising bond rates which most expect the US fed to follow and has already made its first rate hike this month – this facility is becoming closer by the day to being at market rates and may soon even be in the money. If properties were sold individually this would take time and I don’t believe this early repayment penalty would be incurred immediately. And a renegotiation with the Lender is possible.

Thus for URF to deduct the yield maintenance cost of USD 28m of debt and again apply a further 11% discount I believe is inappropriate and another gift to the buyer. See appendix for further detail on this.

NOT A DONE DEAL YET

The deal is primarily contingent upon:

Ordinary shareholders voting in favour

There is roughly three months until the vote – anyone buying ords today will be entitled to vote and there has been plenty of turnover this week

URFPA will not vote as the ASX listing rules overrule the URFPA prospectus – EP1 has confirmed this in writing although almost anything is contestable today but I’d assume this unlikely – see appendix

If the deal is voted down there is a break fee of USD 600k so immaterial for URF

Or if a competing bulk transaction is accepted a USD 5m fee is payable – this is fine providing the competing bid is significantly greater than that value

This may be a reasonable chance now that it’s now clear URF management is happy to sell at a near 19% discount

The bidders have 60 days for further due diligence – they could walk without penalty

Conversely they could also increase their bid if ords holders indicate they’re unlikely to accept a whopping 19% discount – as suggested by the current market price of 22c and prefs at $80

An improved bid from Brooksville/Rockpoint in my opinion would be the best outcome from here and should be driven by the responsible entity led by Stuart Nisbett.

WHO’S ON THE REGISTER

I assume both the ords and prefs are still predominantly owned by current and ex EP1/Dixon advised clients. If they own both ords and URFPA – the current proposal significantly favours URFPA so holders with a higher weighting to prefs presumably benefit so this is something to consider – I have no insight into the rough split between joint owners of prefs and ords.

There is one substantial shareholder – Investment Administration Services with 6.3% – I don’t know who this is but assume it’s on behalf of multiple individuals. There are also a few institutions below substantial however it is a wide open register – this may change in the lead up to the vote.

IF THE DEAL IS VOTED DOWN?

As mentioned properties could be individually sold – or retained. URF has stated the fund will be FFO positive this year – and I believe this could happen very swiftly if URF was to make the appropriate cost reductions. URF currently has stated they’ve kept on the entire team throughout the sales process – which remarkably includes two CEO’s to manage what I consider a passive rent collector! This was justified to market URF to the widest range of possible buyers who may have wanted to take the team with them. Obviously if no deal proceeds and the properties are retained – the G/A cost over AUD 10m which is still an enormous circa 25% of gross rent – is not sustainable.

Unfortunately we don’t get visibility over the two CEO’s pay nor their incentives as this I believe is buried in the G/A costs - however URF have allowed for a USD 900k opex expense assuming the deal was to close in 4-5 months as per their timetable. I believe this provides a good indication for the actual cost to manage URF as a passive rent collecting fund – so I assume AUD 3-4m pa G/A is fair which as a % of revenue is in line with other US Residential REITs. If such cost cuts were made – I estimate the fund would have annual positive FFO of AUD 4-5m which could be conservative.

Keeping the portfolio medium term is extremely unlikely however - and the ords would likely trade at large discount to true realisable value.

There will be no further property disposal costs under this scenario – rent is likely to increase in line with the headlines I continue reading such as Manhattan median rents at all time highs. URFPA will likely be converted due to the onerous interest step up so this cost is no longer incurred and there would be roughly 800m ordinary shares on issue – assuming the maximum cap of 205 ords per pref – see my previous note for more detail.

The debt facility can also able to be repaid at 5% per annum so the interest cost could be lower – URF today has over USD 50m in cash assuming their final properties on market settle. So the FFO could be considerably higher and surplus funds used to either buy back stock as URF has previously indicated – repay debt when permitted – or even return as a dividend to the long suffering shareholders.

FRUTHER CONSIDERATIONS AND RISKS

The 22c remaining for ords assumes the sale of the remaining multi-family investments at book value of USD 10.8m. See the appendix for further detail however if URF is willing to accept a 19% discount on their investment properties – achieving book value maybe optimistic for these assets and they are geared at roughly 67% so any discount or premium may significantly impact this figure. If you assume this is worth nil and URFPA repaid in full – that reduces the balance for ords by circa 3.5 cents.

US HOUSING

URF has gone to serious lengths to indicate how thorough the sales process was of which I’m personally sceptical – however if a near 19% discount to the most recent independent valuations is actually a fair market price and you believe the US housing is topping out as mortgage rates climb – then this is obviously a risk to consider if this deal falls over.

FX

I calculate every 1c move in the AUD/USD results in a 1.5c swing in the ords assuming URFPA is treated as debt. URFPA take no currency risk if repaid as they’re AUD denominated – this doesn’t apply if converted to ords. The AUD/USD has rallied of late considering the demand for commodity exposed currencies but we’ve seen some wild swings over the past few years so I have no conviction here - but any increase in the AUD will hurt ords and vice versa.

URFPA CONVERSION?

URFPA can be mandatorily converted to ordinary shares ONLY by the responsible entity – not pref holders – on 1 Jan 2023. If not converted there will be a 2.5% step from the current coupon rate of 6.25% to 8.75% which ords can’t afford and value will transfer from ords to prefs under that scenario. There is a maximum conversion number for 1 share of URFPA to 205 ords.

By example if in 9 months time URFPA was converted - there would be circa 800m ords on issue if 205 shares issued per pref. If you accept the NTA under the current proposal with the 19% discount - to be USD 214m or AUD 285m – that implies NTA worth 36 cents for ords on a fully converted basis. $80 today seems fair for URFPA considering there is still $6 in dividends this year if this deal does not proceed - so dividing $74 by 205 results to 36 cents.

URF on that basis would be geared closer to 50%. This obviously assumes no bulk transaction occurs.

CONCLUSION

The responsible entity have in my opinion delivered an unacceptable deal for ordinary shareholders. I can understand the potential for a bulk transaction discount – yet near 19% in any market seems excessive – especially when the alternatives include selling individually at a far lower cost OR retaining the portfolio which I believe could easily become FFO positive this year and URF has stated as such.

Personally I believe the best outcome from here is a much improved bid from Brooksville and Rockpoint. URFPA would presumably still be repaid in full so any increase will flow directly to ords.

For example a 10% discount to current property values which still sounds generous in today’s market would result in a further USD 54m returned to ordinary shareholders assuming 75c AUD/USD - or roughly an extra 18 cents per share. In total this would leave 40 cents for ords post a full repayment of URFPA. Clearly the leverage for the ords is significant.

I would strongly suggest to the responsible entity led by Stuart Nisbett to seek an improved outcome as the current proposal seems very unlikely to receive much support as evidenced by todays ords trading at 22c and the prefs at $80.

Charlie Kingston

Director

CSK Capital Pty Ltd

Disclaimer

Do not interpret anything above as financial advice. This article has been prepared by the author, CSK Capital Pty Ltd for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. While the Author believes that such forward-looking statements and opinions are reasonable, they are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author may or may not hold a position in the security mentioned and may trade the security in future. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.

APPENDIX

Below is from the URF Investor Relations team who have elaborated on the tax liability and Yield Maintenance used to justify their 11% discount – along with detail clarifying that ONLY ords can vote on this proposal.

$28m Tax

The US$28m represents the deferred tax liability currently held by the Fund on its balance sheet, being the anticipated FIRPTA withholding tax payable under the current REIT structure if the Fund were to sell its assets on a one-by-one basis. In Australian dollar terms, this liability was held at A$37,190,334 in the Fund’s 31 December 2022 accounts.

$27m Debt Yield Maintenance and how is it calculated

This figure represents the debt yield maintenance expense payable if the Fund were to pay back the outstanding loan balance to Global Atlantic.

As outlined in Note 15(i) in the 2021 Financial Accounts, under the terms of the Global Atlantic loan, there is a limit to the amount of Term Loan component that can be repaid early before incurring a Yield Maintenance Premium. This limit is referred to as the Free Prepayment Amount, and is US$54M during the Yield Maintenance Period of the facility. The US$54M Free Prepayment Amount is subject to a limit that can be repaid early in any one given year. This limit is referred to as the Free Prepayment Annual Amount, and is calculated as 5% of the initial balance of the Term Loan component, or US$18M per year. The annual repayment limit is cumulative, meaning that any unused repayment limit of one year is available to be carried forward to increase the Free Prepayment Annual Amount of subsequent years. For example, if in Year 1 the Group made early Term Loan component repayments equivalent to 2% of inception Term Loan component balance, then in Year 2 the Group can make early Term Loan repayments equivalent to 8% of inception Term Loan component balance before triggering a Yield Maintenance Premium. The Yield Maintenance Premium is applicable only during the Yield Maintenance Period, which period covers the first 4.5 years of the loan facility (dated November 19, 2022). No Yield Maintenance Premium is payable on any early repayment following the cessation of the Yield Maintenance Period.

The Yield Maintenance Premium is calculated as the greater of:

(a) one percent (1%) of the amount of Term Loan component being repaid; and,

(b) the sum of the present values of all then scheduled payments of interest and principal through maturity date, minus the principal amount of the Term Loan component being prepaid.

Unitholder approval

Listing Rule 11.2 applies where a listed entity proposes to dispose of its main undertaking. It requires the entity to obtain the approval of holders of its ordinary securities and comply with ASX requirements for the content of the notice of meeting. The resolution to approve the sale of the URF’s main undertaking will be put as an ordinary resolution of the holders of ordinary securities as required by ASX Listing Rule 11.2. The definitions in the Listing Rules make it clear that CPUs are not “ordinary securities”.

Below is the detail regarding the USD 10.8m of remaining Multi-family assets that URF assumes will sell at book value and what I estimate are geared in total at 67%: