This is 100% my personal view and NOT advice - see disclaimer.

URF.ASX – 29 cents

Very little has changed over the past six months for URF and the thesis remains unchanged although the pace of sales / windup of the portfolio is much slower than expected.

Above is my base case estimate of the current URF balance sheet and adjusts for the sales post 30 September 2023 ($22m USD net of which $14.5m USD went towards debt repayment).

URF still trades at a significant discount to stated NTA of 52% post tax. My base case however assumes the premium segment of the portfolio (roughly 2/3rds) book value is accurate as they have been consistently selling these properties each month at roughly book. Selling costs remain elevated at circa 7% of the gross price – so in my CSK value column I’ve reduced the premium segment by 10% to adjust for this.

The workforce portfolio in NJ which is harder to sell individually and is more suited to an investor / institution to rent rather than live in compared to the single family premium properties. I discount this segment by 35% including selling costs. The current book valuation for workforce uses a 3.64% net operating income yield (NOI) / cap rate which seems far too low given rental growth has slowed and the markets cost of debt is well above that level today.

Large multi family properties have been selling between 5-6% cap rates across America – some much larger REIT’s have surprisingly issued debt recently around 5% albeit they are geared lower than URF - so if I deduct circa 30% for the workforce portfolio and another 5% for selling costs (assume sold in bulk thus lower fees) – which implies a NOI yield / cap rate closer to 5.2% for the URF portfolio which seems fair.

With those values applied – I still get a post tax NTA of 37 cps for URF or a discount of 22%.

The biggest risks in my opinion remain the debt maturity in May 2026 given it’s currently fixed at 4% interest rate and suspect it could be near double if refinanced today - LTV is >50% today. 2026 however or >2 years is a long time in markets and provided URF can sell the current pipeline of 63m USD - this should give the market some confidence albeit even if this went entirely towards debt reduction – it would only reduce debt by 20% so the pace clearly needs to increase. I assume refinancing discussions would occur well before the maturity date if not already.

More relevant for today is the performance fee hurdle rate Brooksville are pegged to being 40 cents AUD + 8% compounding annually which I believe is too high. Personally I’d be happy to accept high 30’s for my shares given the portfolio is still loss making / providing no yield and thus the opportunity cost today is higher – and that seems a fair price given my base assumptions of a 10% hit to premium / 35% hit to workforce. I haven’t adjusted my valuation for the circa $3-4m FFO losses per annum (0.5 cps pa).

Aside from those risks – with rates globally falling and house prices on the rebound – Blackstone the biggest buyer of real estate globally has also re-entered the market buying one of the largest single family home companies Tricon at decent 30% premium to last – the overall macro is improving so URF still seems a solid risk reward today albeit it’s a slow burn.

The register is very tight with STAM / GVF / Almitas / Harvest Lane amongst others presumably all wanting the same thing - a speedy wind up at an appropriate price so it’s a matter of when not if and at what price.

As mentioned we took profits and reduced the URF position last year and partly re-deployed into Vonovia – similar bet - discounted resi albeit in Germany - much more liquid plus VNA generates positive FFO hence has bounced >50% compared to URF which has been flattish (URF hadn’t fallen as hard either hence the relative opp).

Lastly the buyback should continue to support with 10m AUD excess cash remaining with further cash distributions possible especially if they execute the full sales pipeline. We remain long URF.

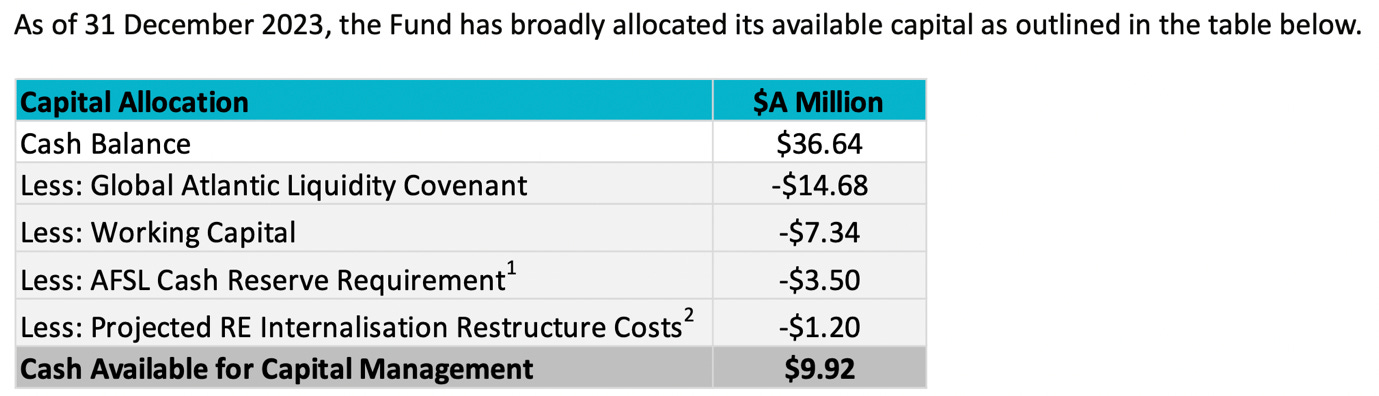

TGP.ASX – 50 cents

Similar to URF - we took some profits in TGP including dividends last year as REIT’s came under pressure - however TGP has been disappointing as we retained a holding. Today TGP trades at a 19% discount to my estimate of NTA of 60 cents – much lower than the company’s figure which uses TOT at NTA compared to the market price – and HPI has fallen significantly since 30 June 2023 NTA.

Along with the broader REIT market TGP was sold off last year but hasn’t bounced back unlike peers - in my view as:

Illiquid small cap REITs have underperformed

Tony Pitt owns >40% today so the market is wary he may try take it private so he may be happy to see it drift lower

The buyback has paused – potentially due to the upcoming results but most companies can get around this

To date the HPI investment has been poor as they paid over $3.50 for their 15% stake compared to today’s price $2.88 (55% NTA)

Funds management business I estimate to be breaking even so has minimal value

TOT has also been sold off (15% of NTA) and the manager TGP can’t grow this vehicle given it trades near 40% discount to NTA

So TGP’s NTA has fallen significantly and the discount has widened. If the market wanted exposure to HPI it could simply buy that stock directly and get arguably more liquidity. HPI trades at a near 30% discount to NTA although the implied cap rate today is around 6.5% which seems reasonable as the portfolio is long WALE 10 years – and has a more resilient distribution with better growth prospects than most ASX REIT’s given the tenant pays most costs including capex – and HPI rentalises anything significant.

HPI certainly has risks however as we believe some properties are overrented – and having exposure to a single tenant (AVC) can be a double edged sword if they decide or threaten to leave. HPI does own the Pokie and liquor licences – not the tenant - which does provide protection however AVC is also owned by PE which could present risks in a few years time if they have over levered as they often do and want lower rents. HPI provides no visibility on affordability metrics for AVC like EBITDA/Rent coverage.

TGP owns a minority 15% stake so has minimal control but the register is wide open so it will be interesting to see if Tony can pull a rabbit out of the hat as he so often does – similar to IAP.ASX – but we are doubtful given the shift in rates although recent M/A in ASX REIT’s like BWP/NPR and APZ/EGH is encouraging.

TOT has a decent portfolio and owns 3 properties (2 brand new) – bought as part of the IAP transaction which in hindsight was a poor decision given they are all commercial / office properties and purchased on 4.5-5% cap rates. TOT had no debt hedging at the time which now incurs a higher interest rate than those cap rates. TGP clipped the ticket for their $2.7m acquisition fee as manager but that has clearly impacted any chance of raising further equity and FUM. TOT is over-geared for a listed REIT so absent any asset sales or dilutive equity raisings – it is in an unfortunate bind albeit self inflicted.

TGP still has circa $40m in cash to deploy but without a liquidity event in HPI which may occur as we saw with LEP taken over by CLW / CHC – TGP is largely constrained from growing their funds management business which the market rightfully places zero / negative value on today.

I don’t want to underestimate Tony as his track record is solid but the HPI investment was a thesis break – at 50 cents however it looks decent value but is mostly a bet on HPI – and if the buyback doesn’t restart with aggression at the current prices it’s only going to increase market suspicion Tony wants to see the stock go lower. A buyback also increases his stake assuming he doesn’t participate – so it’s a win win for him as he gains more control. The thesis has always been backing Tony at a discount – but that maybe the big risk today.

MWY.ASX – 73 cents

MWY has also been disappointing despite finally paying a recent dividend of 5 cents fully franked albeit this is well below the originally indicated 19.5 cents last year – better than nothing however and a positive trend. I expect more to come over the coming 24 months and the thesis remains.

MWY also finally announced a partial sale of their Geelong port land to CHS Broadbent who will build the Grain terminal which should significantly reduce the take or pay liability at the site which in my view was a poison pill for MWY – saving MWY over 4m pa as I estimate the total liability as >$7m pa and they stated CHS will take 1mt pa of the 1.8mt capacity.

CHS have paid $15.5m for 5 hectares (site is 19ha total) so less than 1/3rd of the total land MWY owns. MWY will need to contribute $4.5m in capex so net they will receive 11m although should receive some rent in the interim whilst the site is built out – maybe pay some tax so $11m seems fair. You could be real bullish and extrapolate the $3.1m per ha paid across the remaining 14ha ($43m) but that seems aggressive so I assume the remaining site is worth $15m – slightly below the $16.4m book value pre sale given MWY wasn’t using the portion of the sold land anyway. This will be revalued at the upcoming Feb 2024 results and my figure seems conservative.

As per my table – MWY at the 30 June accounts had basically no bank debt remaining and had circa $1m net cash if you exclude lease liabilities. During FY23 however there was a significant inventory build – circa $14m and the closing inventory balance was $35m which at the time MWY said was elevated as Chinese customers again did not take their full volume.

At the AGM update three months later – inventory has continued to build by another $15m and at the time stood at $50m - definitely a concern. MWY stated their through cycle balance will likely be $30m which in my view is still elevated relative to history despite being a much smaller revenue generating company today than pre COVID. However if they can reduce by $20m this would be a big positive – 30% of the market cap. MWY also announced a new trade finance facility up to $35m – so in theory they could fund the through the cycle inventory build from this and distribute further cash to shareholders.

Lastly MWY has received the FY24 MEAG plantation sale proceeds of $12.4m – has paid a $4.4m dividend – and in FY25 will receive the final net of tax MEAG proceeds of 20m – so assuming MWY breaks even from here which is my base case – it could have near $40m of net cash – most of which could and should be returned to shareholders through further fully franked dividends. Franking balance should be circa $20m once the final MEAG payments received.

So $40m net cash (over next 12mths and assuming inventory cleared) compared to the market cap today of $64m - an EV of $24m.

MWY still retains the 15ha of prime Geelong port freehold $15m (CSK estimate) – their JV with Mitsui (SWF) which is accounted for using share of net assets – mostly cash and property of $13.4m – plant and equipment of $20m – an impaired but potentially recoverable receivable of $7.8m from the Tiwi’s (low probability however) – and 30m of inventory.

So plenty of tangible assets remain in excess of todays EV.

MWY last year made “underlying” $2.9m EBITDA which is accounting rubbish in my opinion as the cashflow from operations was an outflow of $12.3m and that’s before capex of $4m and lease interest of $4m – so the true FCF was near $20m loss – $14m of which was attributed to the inventory build so adjusting for that a $6m FCF loss.

I timed the cycle incorrectly and overestimated the quality of the business which I now accept is highly reliant upon Chinese customers who are extremely fickle and have multiple alternative sources. I also missed the structural issues in that the key earnings generator was Geelong which today has much less supply coming through so a return to the glory days of EBITDA >$30m are extremely unlikely.

Nevertheless Tony Mckenna (CEO) at the AGM stated his target for the Woodchip earnings division through cycle to be $10-15m – unclear whether that’s EBITDA or FCF – I assume EBITDA.

But if that is achievable – and assuming MWY can break even (a big if given track record) – reduce inventory by $20m – an EV of $25m or circa 2x at today prices suggests minimal if any expectation of the cycle ever turning back in MWYs favour which I find harsh.

It also prices in minimal if any upside from the carbon opportunity MWY is pivoting towards – fair enough given they have delivered zero to date – but the wealth created by almost every private peer has been enormous and the carbon credit market will continue to grow in Australia – particularly for high quality credits / ACCU’s which MWY should be able to benefit from.

I personally believe a board refresh is required – the Chairman Gordon Davis has been there since day 1 at the IPO at $2.50 so has overseen 70% capital loss for IPO shareholders – he has minimal shares and his salary is near double their value. His other long term listed directorship at Healius (HLS.ASX) is troubling as evidenced by their recent share price collapse and emergency capital raising (we bought some HLS at $1.20 post collapse).

I am disappointed with how Tony the CEO is remunerated with his hurdles tied to relative TSR – so provided MWY outperforms the market from the current depressed share price he will get paid which is an extremely low hurdle.

In summary – MWY has finally delivered some positive news and very little of this is reflected in the price. The weather has been poor as has Chinese export data so it may be another weak half for MWY when reporting in Feb 2024 - but I remain long and expect much of my capital to be returned in the coming years.

Charlie Kingston

Director

CSK Capital Pty Ltd

Disclaimer

Do not interpret anything above as financial advice. This article has been prepared by the author, CSK Capital Pty Ltd for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. While the Author believes that such forward-looking statements and opinions are reasonable, they are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author may or may not hold a position in the security mentioned and may trade the security in future. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.