TGF.ASX

Commodity LIC trading at a deserved 27% discount to NTA - but the reputational damage may force structural change to access this NTA despite resistance to date

This is 100% my personal view and NOT advice - see disclaimer.

TGF.ASX - $1.25

TGF is an externally managed Australian commodity specialist Listed Investment Company (LIC) - managed by Tribeca - with a market cap just under 100m.

TGF trades at one of the biggest / worst discounts to net tangible assets (NTA) on the ASX - near 27% pre tax and 34% post tax.

Per the below – the discount seems chronic - albeit may be overstated as whilst 90% of the fund is in direct equities - around 10% of the fund is in unlisted / related party funds mostly exposed to diamonds. The commodity has been smashed of late - yet the value of this fund has not moved - unlike their related party carbon credit fund that has fallen over 80%.

The simple thesis is whether TGF can turnaround performance from here or adopt structural change to narrow the discount. We have a >20% head start given the current discount.

With lengthy underperformance, they are on their last chance to turn this around. If the manager can’t deliver, a structural solution should be adopted to fix the discount e.g converting to an unlisted fund and permitting exit at near NTA - which the manager has resisted to date.

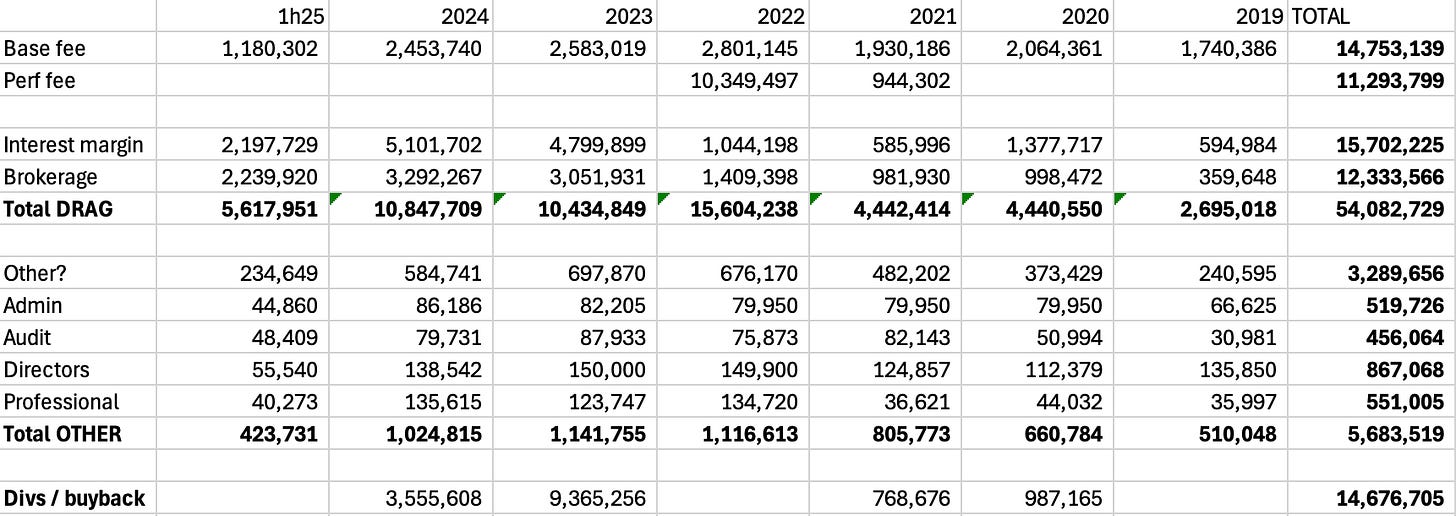

A key reason against a conversion is the fees involved which the manager did not quantify - which is ironic given over 2/3rds of the TGF NTA losses to date reflect the manager fees plus brokerage / interest - 54m total since IPO compared to the initial raise of 160m.

Per the 1940 book “Where Are The Customers Yachts?” - TGF could be the Tribeca edition?

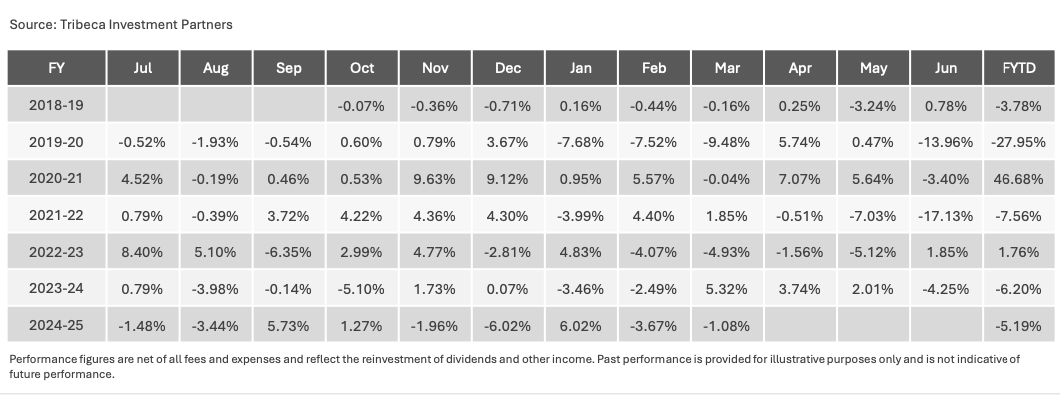

Since the TGF 2018 IPO at $2.50:

Pre tax NTA is down near 30%

But the share price down near 50%

Massively underperforming the Australian Resource Index (XJR) by a similar margin

The Metals / Mining index (XMM) underperformance is worse >80% without adjusting for dividends.

A significant contributor to this loss has been the fees the manager - Tribeca - has extracted (26m / 33 cps / 13% of IPO price) using todays share count.

TGF has paid in brokerage / interest (28m / 36 cps / 14% of IPO price).

Thus fees/brokerage/interest account for roughly 2/3rds of the loss in NTA or a whopping 54m combined over six and a half years.

This average drag over six years is 8m pa – or near 6% of the pre tax NTA today and this is before “other costs” that I’ll come too.

The Tribeca fees alone (26m) are far greater than the amount TGF has returned in dividends and the buy back (14.7m).

The manager has no benchmark for their 20% performance fee – merely a high water mark – hence the significant >10m fee in 2022 but unfortunately there is no claw-back on this.

The fund is geared and the base fee is 1.5% of Gross Assets (GAV) which may encourage such gearing and has amplified losses to date.

Another significant drag is the mysterious “other expense” line - which has steadily increased since IPO peaking near 700k in 2023 and never explained in the financial accounts - travel maybe? some expensive flights if so…

Along with professional fees, director fees, admin fees etc… total other expenses average around 1m pa - another nasty drag.

RAISING EQUITY AT A DISCOUNT - TO SOLVE FOR THE DISCOUNT?

Another contributor to the loss from IPO was in 2023 when the manager tried to raise 50m in new equity at a price of $2.10 – a nasty 23% discount to the pre tax NTA at the time.

The rights issue component was hugely undersubscribed but this shortfall was placed - the majority to new institutions anyway - furthering dilution to non participating holders.

The justification for the dilutive raise was in part the opportunity set at the time - growing demand / less supply / same as any commodity thesis I’ve seen - albeit the NTA is down significantly since.

Another reason was to grow the fund size (resulting in more fees) to help improve trading liquidity for TGF in order to close the discount.

Raising dilutive equity - at a discount to NTA and >15% below the IPO price from five years prior – as a solution to close the current discount to NTA? In my view is the polar opposite of what should be done…

TGF had previously tried but gave up on a miniscule buyback in 2020 with only 1.5m shares repurchased or sub 2% of the total shares. Buybacks result in lower GAV and fees - might this explain the the managers preferred solution of raising equity to close the discount?

Geoff Wilson the king of ASX LIC’s called this out stating he couldn’t understand “how the board justifies to shareholders doing a placement to new shareholders at a discount to NTA”.

SO WHY MY INTEREST?

I believe the reputational damage of this under-performance and clear misaligned outcome to date whereby the manager / brokers have extracted enormous fees directly at the expense of the shareholders - will ultimately force structural change – absent a massive turnaround in performance.

I also like the sector / thematic TGF is exposed to with over half the fund in precious / base metals. Gold in particular has soared of late – making TGF under-performance all the more confusing?

STRUCTURAL CHANGES / STRATEGIC REVIEW

Tribeca - who is reasonably well known in Australia – could and should allow shareholders access to their NTA or close to it by converting to an unlisted structure.

Fund managers like Magellan - Forager - Platinum - Antipodes and many more have provided their shareholders - the owners of the business - a simple vote to make this change and access their NTA.

This is Tribeca’s only listed fund – and they manage a similar albeit more levered unlisted strategy - hence any conversion should be relatively simple process despite their objections to date.

In November 2024 TGF however did conclude a strategic review – lead by the supposedly independent Chair Rebecca O’Dwyer - in assessing a potential conversion.

This amounted to zero - deeming it not in the best interests of shareholders to make any change due to:

Fees involved - that they did not quantify – albeit clearly this would be less than the current >25% discount to NTA? peer conversions generally have cost 1-3% of NTA.

The loss of a deferred tax asset (14m / 18 cps) which is the direct result of the losses the manager has delivered to date? and may never be recovered as an asset if the fund can’t improve performance noting TGF has fallen five out of seven years thus far.

TGF owns unlisted related party funds including the VT Carbon Credit fund that has fallen over 80% since investing (thankfully <2% of the fund today).

Along with an unlisted Tribeca Diamond fund (7% of the fund) and the diamond market has been smashed so this could well be overstated?

These unlisted funds were a reason for not converting - however many peers / LICs have faced similar situations and made separate carve outs to facilitate a conversion.

So in my view none of the Rebecca O’Dwyer endorsed reasoning is sufficient to not pursue a structural conversion to permit long suffering investors an exit at NTA.

To argue that the costs involved are their key reason against a potential conversion – which might be similar if not less than the cost of the managers annual base fee alone? (let alone brokerage and interest) – seems highly disingenuous.

Hence the ever widening discount and the stock has fallen significantly since this decision.

The manager should present the complete facts of their review – and allow shareholders – the owners of the company – to vote on this themselves.

A relatively open register may help drive future change. Ben Clearly the current portfolio manager and Tribecca are the largest combined / non independent shareholders with near 5% – but there are no other substantial shareholders of note.

Ben Cleary - who owns a portion of Tribeca the manager (unclear the %) - and thus benefits from the fees extracted – often cites TGF alignment given this stake. Whilst they are sitting on a loss since IPO and from buying more along the way – his 3.1m shares – and Tribecca’s 750k – is worth less than $5m today – which is immaterial relative to the $26m fees to date paid to Tribecca.

Ben and other true believers can still participate in the strategy in an unlisted structure and benefit if BHP does hit $100 as he once suggested:

TGF also included the below in their most recent semi annual presentation (with an underwhelming recorded video and zero opportunity for Q/A) – stating it’s time to back up the truck:

For those however who do not wish to back up the truck after suffering a capital loss of near 50% over 6.5 years - should be entitled to exit at NTA - an improved outcome but still nasty near 30% capital loss. TGF owns mostly liquid large cap equities thus any redemptions if unlisted could be done presumably without price impact.

SUMMARY

To repeat the biggest risk is the continued fee drag and poor performance – and the manager Tribeca has an initial management term of ten years (over three years remaining) at which stage they can be removed without cost subject to an ordinary resolution. I suspect in the interim however:

Either the TGF performance improves and the stock goes up (unless the discount widens further which is possible)

Or the likely reputational damage of further losses will result in the manager Tribeca taking decisive action to close the discount (preferably not through another equity raise)

We have a >20% head-start to protect against any further losses (I mark down the unlisted / diamond exposure given the diamond price performance – see appendix)

Hence I have a small position as it does seem unsustainable given what most reputable closed end fund managers in Australia and globally are doing to rectify their discounts to NTA – and eventually I see TGF as no exception.

Charlie Kingston

Director

CSK Capital Pty Ltd

Disclaimer

Do not interpret anything above as financial advice. This article has been prepared by the author, CSK Capital Pty Ltd for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. While the Author believes that such forward-looking statements and opinions are reasonable, they are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author may or may not hold a position in the security mentioned and may trade the security in future. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.

APPENDIX:

Diamond price chart below along with an article referring to the Kimberly Diamond trust which TGF owns 62.5% of (they also own 48% of the VT Carbon fund).

The diamonds are clearly rare and don’t have their own index - the article cites one diamond which presumably the fund doesn’t own as it was worth 18m - hence the pricing of this fund is clearly illiquid and opaque - I apply a conservative 50% discount which still results in a 22% discount to pre tax NTA today.

https://www.afr.com/markets/commodities/hero-diamonds-form-basis-of-tribeca-s-new-50m-fund-20220717-p5b27q

What do you think of the investment managers of this fund?