CEH.ASX

Theme Park turnaround with excess cash and implied discount to recent capex spend..

This is 100% my personal view and NOT advice - see disclaimer.

I am long CEH.ASX at the time of writing.

CEH.ASX - 46 cents

Coast Entertainment CEH.ASX (formerly Ardent Leisure) owns theme parks and attractions in the Gold Coast Australia – Dreamworld & WhiteWater World (DW) and SkyPoint. In 2022 CEH sold its Main Event division – returned over $450m to shareholders or 95 cent ps part dividend / capital return – paid off all corporate debt and retained circa $150m of net cash.

The short pitch on CEH today:

market cap of $212m at 46 cps

NTA of $252m or 55 cps

$118m of net cash remaining (as at 26 Dec 2023 update) albeit CEH has committed to spending circa $40m of this on capex / new rides and attractions ($60m initially committed so 1/3rd through) over the next 12 months

burning circa $10m cash pa bottom line from operating losses – theme parks division should produce minor but positive EBITDA of circa $2-3m – less $8m capex – less $8m overhead – plus $2-3m interest earnings.

so the remaining net cash should settle in 12mths around $70m pre buying back additional stock which is ongoing (circa $11m balance)

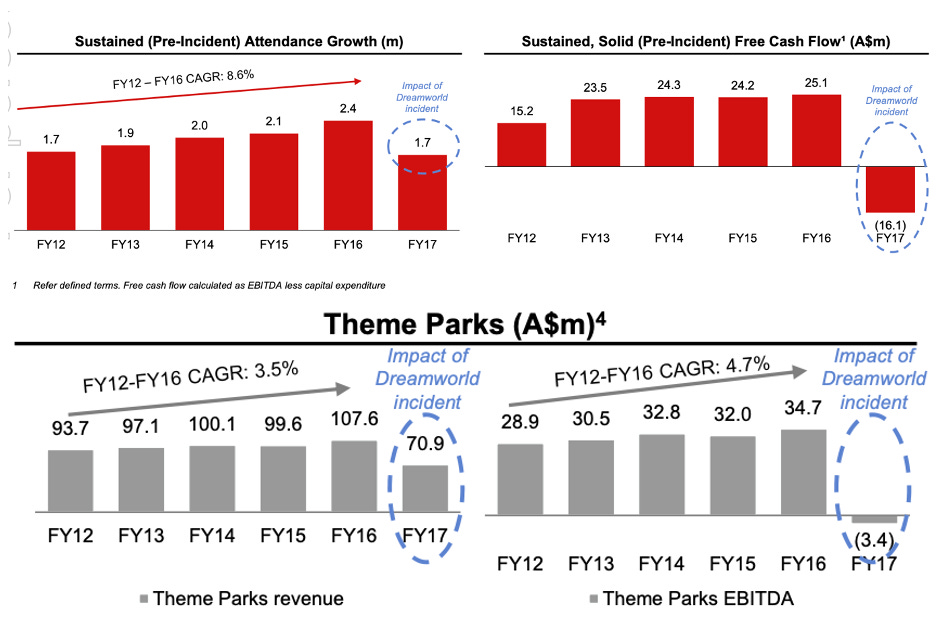

The assets are thus valued at an enterprise value (EV) of $143m which in the four years prior 2016 consistently made >$20m FCF and >$30m EBITDA per annum. A tragedy occurred in 2016 however and DW has never recovered similar attendance nor profitability levels – I don’t believe this is structural but the key issue is timing and if changes to management / board and strategy are required to achieve a turnaround.

I assume SkyPoint which is included in theme parks division - is worth circa $30m in line with the most recent independent valuation four years ago and will be updated in the coming Feb 2024 results. It was purchased for $13.5m in 2009 and owns the top two levels of a 77 floor residential tower in the Gold Coast plus the roof rights which people currently climb (assume it would make a nice penthouse if the current offering failed). Earnings are not split out but it is profitable.

DW operates on 55ha of freehold land – of which roughly half is unutilised and considered excess. The company has stated it would crystallise this value for over six years but has little to show for it. There is a pending development application of which we should know the results mid 2024. There have been multiple recent comparable transactions (see appendix) that would support a valuation of at minimum $25m based on useable hectares.

So if we deduct 30m for SkyPoint and 25m for excess land – the implied value for DW today is circa 90m rounded up.

This compares to the $127m of property plant and equipment at cost less depreciation ($334m cost most attributable to DW) – and ascribes no value to the $130m of tax losses the company states has a tax benefit of $53.7m. This seems fair given the theme park division has lost money for >six years now.

The $90m implied valuation for DW is 25% less than the cash spent on capex >$120m including pending rides / attractions over the past six years! No doubt they have overcapitalised the new rides but this does seem harsh but hence the opportunity.

Theme Parks are capex sinks and require significant refurbs every 10 or so years - but can produce significant free cash (FCF) in the interim years so best to buy once ex capex.

US listed theme park peers trade between 7-10x EBITDA – most have highly levered balance sheets and all but one (Six Flags - which is currently being acquired by Cedar Fair) have sold and leased back land so CEH assuming it can finally deliver similar levels of EBITDA to pre tragedy of >$30m – should warrant a higher multiple than listed peers.

My key question is when rather than if the turnaround occurs so my time frame is 1-2 years for the CEH thesis as the capex / new rides won’t be complete for another year or so – but there are other potential catalysts in the interim eg excess land sale and further capital returns.

If CEH can return to pre tragedy 2016 EBITDA or >30m EBITDA – less maintenance capex and overhead - 6x EV/EBIT seems solid value for a net cash post refurb theme park operator (I assume Skypoint is a minor contributor to overall EBITDA of circa 10%).

DW main competitor and previously listed Village Roadshow (VRL) was acquired in 2022 by BGH – two US peers are currently merging Six Flags and Cedar Fair – Blackstone has acquired multiple listed and unlisted theme park operations over the past few years and has openly stated it wants to grow in Australia – so M/A would not surprise from here.

Can DW return to pre tragedy earnings?

In 2016 a tragedy occurred at DW that resulted in four deaths so attendance fell significantly. There was a nasty period of media coverage during the inquest / coroners investigation although momentum was finally returning for DW – but then COVID hit in 2020 and obviously all theme parks globally were affected. The theme park division (DW + SkyPoint) has lost money ever since until the first half of 2023 when it made an adjusted EBITDA of $4.3m albeit this is pre overhead.

As per the recent update (16/01/2024) the weather has been poor over the key Xmas trading period resulting in lost trading days and the company has guided to positive EBITDA however less than prior period which the market was clearly disappointed with but expecting given the recent selloff.

The corporate overhead is roughly $8m pa – half of which is insurance – and maintenance capex has generally been around $8m pa. If we then add my assumed minor EBITDA of $2-3m – plus $2-3m if interest income – CEH I assume is currently burning $10m pa.

This despite ticket pricing being the highest since FY16 – up 11.6% on PCP – and attendance up 6.5% at the recent update - yet revenue was somehow flat vs PCP.

For CEH to return to profitability it needs to increase attendance – in 2016 this peaked at 2.4m visitors – FY23 it was half that level at 1.2m despite a local tourism boom. International travellers have yet to return which historically accounted for 15-20% of revenue.

So despite enormous capex being spent introducing new world class rides and attractions – a shift towards premiumisation of ticket sales – and other strategy shifts from the current board / management – customers have not returned and with a highly fixed cost business - visitation is a key variable so earnings remain poor.

I do believe however once all rides and attractions are finally complete – DW will have a strong offering – personally I used to live nearby and the wife and kiddies would often attend given the wildlife and kids facilities were great - superior to VRL so DW does have points of differentiation.

Does the board need to change?

Firstly the current board of five consists of 3 international directors which makes no sense now CEH has only Australian based assets – and a director at the recent AGM said he had not visited the theme parks since pre COVID.

More importantly the market is losing faith the capex spent will deliver a return to pre tragedy earnings and rightfully so given the current Chairman Gary Weiss came to power in 2017 after a very active and public campaign (see appendix) – indicating in a presentation by he and associates if elected they would:

spend $25m on capex to return to pre tragedy metrics – today >$120m has been spent / committed to and visitation / profitability has not recovered

deliver a value uplift of $275m for shareholders and stated the “equity value potential” for the theme parks division was $431m – compared to the current EV post capex of $143m

sell the excess land for $25m – instead they sold a small parcel of land for $2.5m in 2020 – tried but failed to have a developer build a hotel – and we need to wait until mid 2024 for their D/A plans will finally be revealed

So it is no surprise the market has lost patience based on the sagging share price. During the Chairman’ Campaign over six long years ago - the share price when adjusted for the Main Event 95 cent ps capital return was around $1 (trading around $2 during the Chairman’s Campaign) – so the market today values DW less than half the value >six years later.

We were very vocal at the recent AGM and have communicated our concerns through writing to shareholders. See below the key slide from the Chairman’s Campaign presentation in 2017 – link in appendix.

Catalysts?

The 1H24 result has largely been flagged so apart from the updated SkyPoint valuation I expect minimal new news when they report in Feb 2024. So aside from domestic tourism trends and the weather – the next catalyst is mid 2024 when the plans for the excess land should be finally revealed. Management has refused to put a figure on the value uplift they can deliver – merely saying that at least the land value isn’t going down in value… unlike the share price.

The buyback has restarted post the earnings update which has provided support – and we would encourage the buyback to be increased once the initial 10% of shares outstanding is complete as post capex and operating losses – the company will likely have >$50m excess cash and no debt.

Again this compares to CEH global peers who are heavily indebted – most have sold and leased back their land / property including VRL – so CEH has an extremely lazy balance sheet in comparison. Management in my view hasn’t earned the right to withhold such excess capital especially considering the failed capex to date.

Why hasn’t CEH been acquired?

There has been plenty of M/A in the theme park sector – see appendix – but most recently the head of Blackstone was quoted when visiting Australia that one of his six key themes were “theme parks, water parks”. Blackstone also part own Merlin Entertainments which was previously public – and mid 2023 the CEO of Merlin was quoted:

“I wonder why we don’t have a Legoland Resort here, maybe on the Gold Coast, it has to be a possibility… there should be a Legoland Resort on the Gold Coast - whether that's tomorrow or years from now, and whether that's a repurposing of an existing park or a building a new park, that'd be something that likely happens at some point.”

DW has had a certified Lego Store on site at DW for many years so I wonder if the CEH board considered this quote prior to commencing the 50-60m of new capex rather than engaging with Merlin/Blackstone to assist in their Gold Coast ambitions.

Maybe the Gold Coast doesn’t need two theme parks less than 10 minutes away from each other – and DW definitely doesn’t have the same brand power like Disney Land or even MovieWorld (VRL) but purely based on the FCF CEH delivered pre 2016 and differentiated offering – that suggests there is enough room for both CEH and VRL despite their revenue being 3-4x that of CEH currently. It is concerning however that VRL is delivering significant EBITDA which is commonly accepted so the weather and other excuses provided by CEH carry less substance.

REGISTER?

To be fair to the Chairman – he is aligned with an indirect 9.5% stake through the listed investment vehicle Ariadne of which he is a major shareholder and Executive Director. I assume based on the previous capital returns and current buyback – the risk of the >$50m excess cash being wasted on M/A is very low – clearly our preference and the markets is for further capital returns.

Perpetual have held CEH for years – as have FIL albeit recently sold down so assume that’s a short term overhang. River Capital are relatively new and generally take a concentrated approach.

SUMMARY

I can understand why CEH is trading so poorly however at the current price I view the downside as limited.

Either the current Board and management can deliver a solid return on the significant capex in the next year or two and crystallise value on the balance sheet – or the market will likely require a change at the helm - and M/A is a reasonable chance although not a prerequisite for the thesis to work.

I am long CEH and believe it’s an asymmetric bet albeit could take 1-2 years crystallise value.

Charlie Kingston

Director

CSK Capital Pty Ltd

Disclaimer

Do not interpret anything above as financial advice. This article has been prepared by the author, CSK Capital Pty Ltd for informational & educational purposes only. The writing contains certain forward-looking statements and opinions which are based on the Author’s analysis of publicly available information believed to be accurate and reliable. While the Author believes that such forward-looking statements and opinions are reasonable, they are subject to unknown risks, uncertainties and other factors that could cause actual results to differ materially from those projected. As of the date the Report is published, the Author may or may not hold a position in the security mentioned and may trade the security in future. Nothing in this Report constitutes investment advice. Readers should conduct their own due diligence and research and make their own investment decisions.

APPENDIX

Chairman’s Campaign / 2017 presentation:

https://www.viburnumfunds.com.au/wp-content/uploads/2017/10/Ardent-Leisure_A-Plan-To-Deliver-Up-To-1-Billion-of-Additional-Value3.pdf

M/A:

- Six Flags and Cedar woods in the US are currently merging

- VRL acquired in 2022 by Blackstone for an implied value of 550m / 7x EBITDA but the independent expert valuation placed a higher multiple in the cinema division which in my view is harsh and largely academic

- Blackstone acquired Merlin 2019 – 6b GBP EV – 10.2x historical EBITDA

- Blackstone acquired 65% of Great Wolf Resorts in 2019 – 2.9b USD implied valuation

LAND COMPARABLES:

Bob El – 177mill – 161ha 1.1m per ha – May 2023 – 130ha useable – $1.36m useable but mostly forest/uncleared today

https://www.theurbandeveloper.com/articles/bob-ell-coomera-land-sold-record-queensland

147 Billinghurst Crescent sold for $4.8m – 2.7m useable ha – but koala habitat so awkward land and hard to develop – October 2023

https://property.jll.com.au/land-sale/upper-coomera/147-billinghurst-crescent-342267

Village sale lease back

154ha – $110mill – $6.2m lease back – Dec 2017 – $714k per ha although not disclosed how much was useable land

Stockland Foreshaw – 116ha – 40mill – Feb 2016 – $344k per ha but lots unusable so not entirely comparable

https://www.stockland.com.au/media-centre/media-releases/stockland-acquires-coomera-residential-site

Tesla was rumoured to have interest at $35m for this site – 7/11 sold for $8.5m with 400k rent – so 27m for vacant land – roughly 2ha

Thanks for the write up Charlie, well written as always. I hadn’t come across this business before, out of curiosity how did you find it? It seems a bit similar to MWY in some ways: discount to book value, unprofitable, management overpromise and fail to deliver, share price in long-term decline.

It is a bit disconcerting that management aren't willing to put up the for sale sign and conserve capital. That would seem the best strategy for shareholders based on my read but it seems like M&A would need to be driven by buyers.

One reflection I have had from visiting GC is how expensive the theme parks are there. Last time I was there and I think it's still about right it seemed like about $800 for a family of 4. I compare it to Universal Studios in Singapore which is half the price roughly and Legoland in Korea which was ~$100 per person fro.m memory. Both were awesome and I can see the sense in bringing Legoland to Aus, noting the one in Korea is actually in a remote location and not an international tourist hub. Which is a long way of saying I'm not sure the (main) product CEH is offering is competitive, though I didn't fork out the $800 so can't be sure.

Nice succinct write-up Charlie. Some comments:

1. The downside does seem adequately protected, albeit it is worth benchmarking pricing for i.e. a day pass to Dreamworld vs. the other theme parks vs. other local entertainment options. My impression from visiting Movieworld recently was that price has been increased significantly, and thus may be exposed to a pricing reset in the case of sustained discretionary spending weakness in Australia.

2. It's hard to gauge whether the economic value of the theme park business model has been permanently impaired or not by the rise of alternate entertainment methods (i.e. mainly kids being more interested in iPad's vs. real life experiences these days!). As you mention though, VRL seems to be doing okay which suggests this isn't the case.

3. Obviously the main constraint limiting new investor involvement here is the asking of the question "what has changed?". The same mgmt / BoD are there, and based on their track record, probably implies that any incremental news is slanted towards being negative vs. positive (i.e. DA delays, capex overruns, capital allocation silliness). IMO the opportunity is too small for a larger activist fund to get involved to shake things up unfortunately.

4. IMO the most efficient way to crystallise value here is to somehow get the BoD / mgmt to announce a strategic review for the existing assets. It would be worth knowing whether they shopped the Aus domestic assets whilst conducting the strategic review for Main Event a couple of years ago.